Philadelphia City Snapshot

Manufacturing — particularly specialized, small-batch production — benefits from being in cities, and cities benefit from manufacturing. Firms tap rich labor markets as well as dense, sophisticated consumer markets for their finished goods. Firms also benefit from cross-sector collaboration that contributes to urban manufacturing’s high value of production, including with designers, technologists, and scientists. Cities see this emerging sector as rich with possibility for promoting entrepreneurship, innovation, and economic growth. But many city decision-makers have expressed that they have limited knowledge or available information about smaller-scale manufacturers. These innovative businesses, which often combine design, art, and production, frequently do not fall neatly into the data collection categories the government has used for generations to classify manufacturers. Furthermore, the data that do exist are often at the metropolitan level, which can swamp this sector’s nuances as it establishes itself in modest-sized clusters at the hearts of cities. The result is a dearth of understanding by city policymakers on this important sector within their boundaries. Ultimately, urban manufacturers’ impact, potential, and needs are poorly understood.

The Urban Manufacturing Alliance (UMA) conceived the State of Urban Manufacturing (SUM) study as a way to fill this information gap in order to begin to give policymakers, economic development practitioners, and workforce training providers information they can use to make strategic decisions to support urban manufacturers. Longer term, this information may serve as a foundation to expand understanding across the economic development field. To inform this national research, UMA collected information directly from hundreds of manufacturers — including more than 100 in Philadelphia — on the nature of their businesses and the challenges they face; the research team also spoke with a variety of organizations that aim to support these firms.

The Urban Manufacturing Alliance (UMA) conceived the State of Urban Manufacturing (SUM) study as a way to fill this information gap in order to begin to give policymakers, economic development practitioners, and workforce training providers information they can use to make strategic decisions to support urban manufacturers. Longer term, this information may serve as a foundation to expand understanding across the economic development field. To inform this national research, UMA collected information directly from hundreds of manufacturers — including more than 100 in Philadelphia — on the nature of their businesses and the challenges they face; the research team also spoke with a variety of organizations that aim to support these firms.

The Federal Reserve Bank of Philadelphia and UMA partnered to begin to understand what the urban manufacturing sector looks like in Philadelphia, including who its entrepreneurs and employees are; where there are opportunities to increase interactions between smaller manufacturers and larger, more established producers; and what cities can do to help firms thrive and grow into larger jobs generators. We jointly summarize our findings in this snapshot of Philadelphia. UMA will develop similar snapshots for five other inaugural SUM cities — Baltimore, Cincinnati, Detroit, Milwaukee, and Portland, OR — as well as a national report that will identify promising practices across all six cities that other jurisdictions across the country can employ to help urban manufacturers succeed. Finally, UMA will develop a manufacturing ecosystem map for each city to help producers and the organizations that support them match the right resources to businesses’ needs.

Methodology

The State of Urban Manufacturing was conducted in two phases beginning in early 2016. Phase 1 helped set the context across the country for urban manufacturing by analyzing publicly available data over a decade (2004–2014) from 16 metropolitan statistical areas (MSAs).1 These MSAs represent a cross-section in terms of size, geographic region, and dominant manufacturing trends or “typologies” (i.e., metros seeing growth in activity driven by one major industry; metros heavily focused on the innovation economy and advanced manufacturing; large metros with a diversified manufacturing base; smaller metros that are growing the fastest, both in terms of population and jobs; and metros with a strong artisanal/craft production sector). The indicators evaluated include: changes in the number of jobs and establishments; wage rates and their changes over time; demographics and education of the workforce; and the contribution of the manufacturing sector to local gross domestic product.

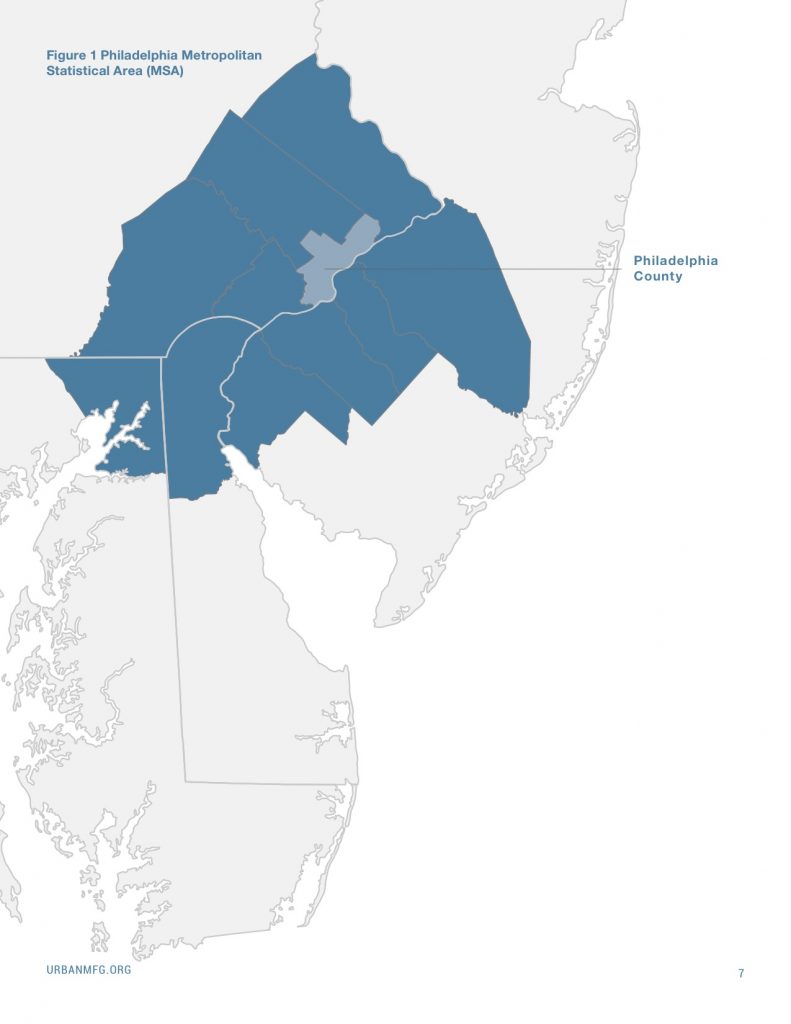

UMA’s national report and snapshots for the other five cities use Phase 1 data to help describe the manufacturing landscape in these MSAs. In this snapshot, rather than focusing exclusively on the Philadelphia MSA, we use publicly available County Business Patterns data produced by the U.S. Census Bureau to describe the manufacturing sector in the city of Philadelphia, as well, as seen in Figure 1.2,3

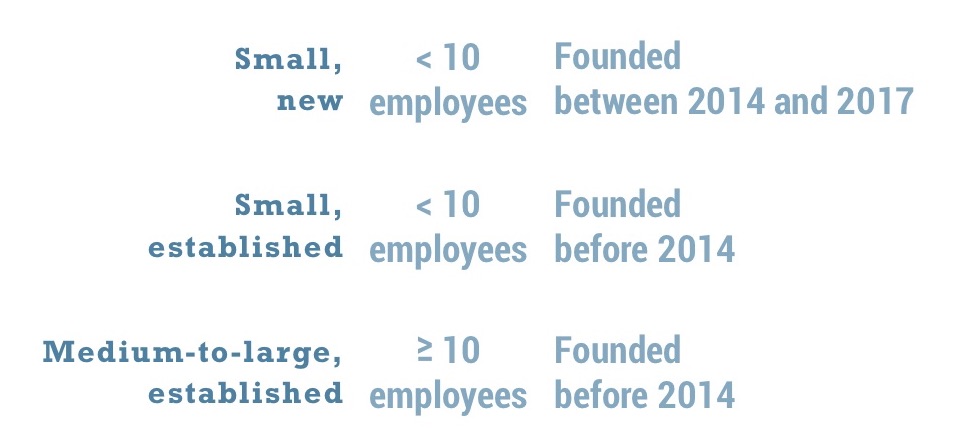

To use the survey results to evaluate differences across groups of similar respondents, we categorized each firm based on its size (as measured by number of employees) and age.

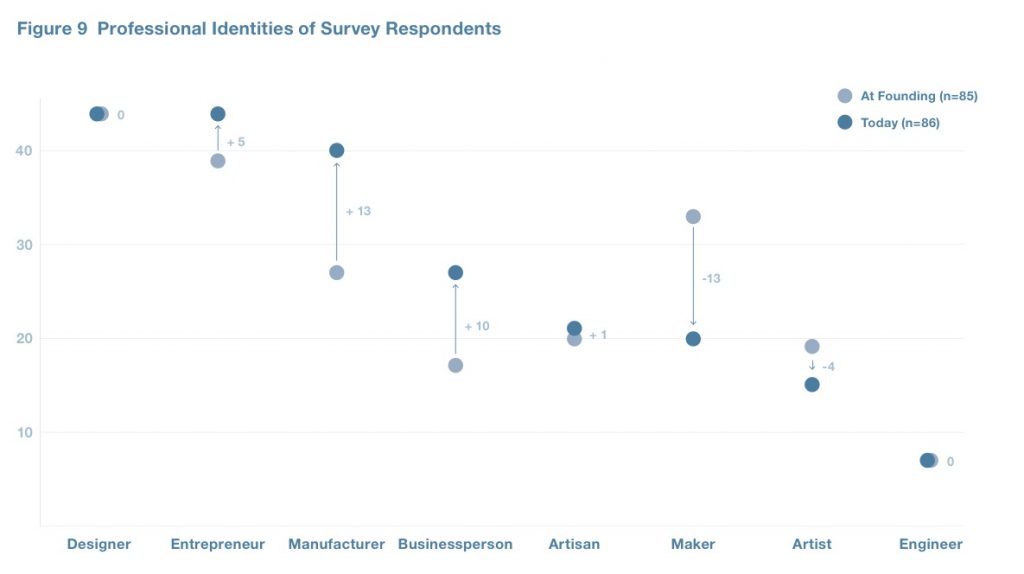

Finally, the examination of urban manufacturing — particularly small-scale urban manufacturing — is challenged by definitional issues. For instance, some producers embrace the term “maker” while others eschew it. Other research is beginning to explore ways of capturing these notions in a more structured framework.4 Rather than impose a structure that is still not fully defined, we enlisted survey respondents to help advance the field’s understanding by asking them how they defined themselves at the founding of their business versus the time they participated in the survey. Respondents could choose up to three from among choices such as maker, businessperson, designer, manufacturer, artist, and entrepreneur.

Limitations

The State of Urban Manufacturing advances the field’s understanding of the urban manufacturing sector simply by providing perspective on what manufacturers are experiencing in terms of business ownership and growth. However, our study has a few limitations that are worth identifying.

The main limitation is that, because we did not have a master list of manufacturers and makers operating in Philadelphia at our disposal, we could not sample survey respondents or focus group participants at random in Phase 2. Instead, we relied on community partners working with manufacturers to promote the survey and focus groups. As a result, participation in Philadelphia — and likewise the other cities — likely reflects the types of businesses our partners interact with most. Thus, our findings are not necessarily representative of manufacturers in Philadelphia as a whole.

The relatively small sample size also limits the strength of the conclusions that we are able to draw from the study. A total of 91 respondents participated in the survey, and representatives from 28 companies and other organizations joined us for the three focus groups. However, our findings in Philadelphia are based on fewer than 119 unique perspectives because focus group participants were strongly encouraged to also complete the survey.

Although a larger sample size overall, and a greater representation of medium-to-large established businesses in particular, would have been preferable, this study has significantly increased our understanding of the manufacturing sector in Philadelphia and uncovered topics that are worthy of additional exploration.

Defining the Local Manufacturing Ecosystem with Publicly Available Data

In this section, we use publicly available data to compare the local manufacturing sector in the city of Philadelphia with the manufacturing sector in the larger MSA.5

Key Sectors

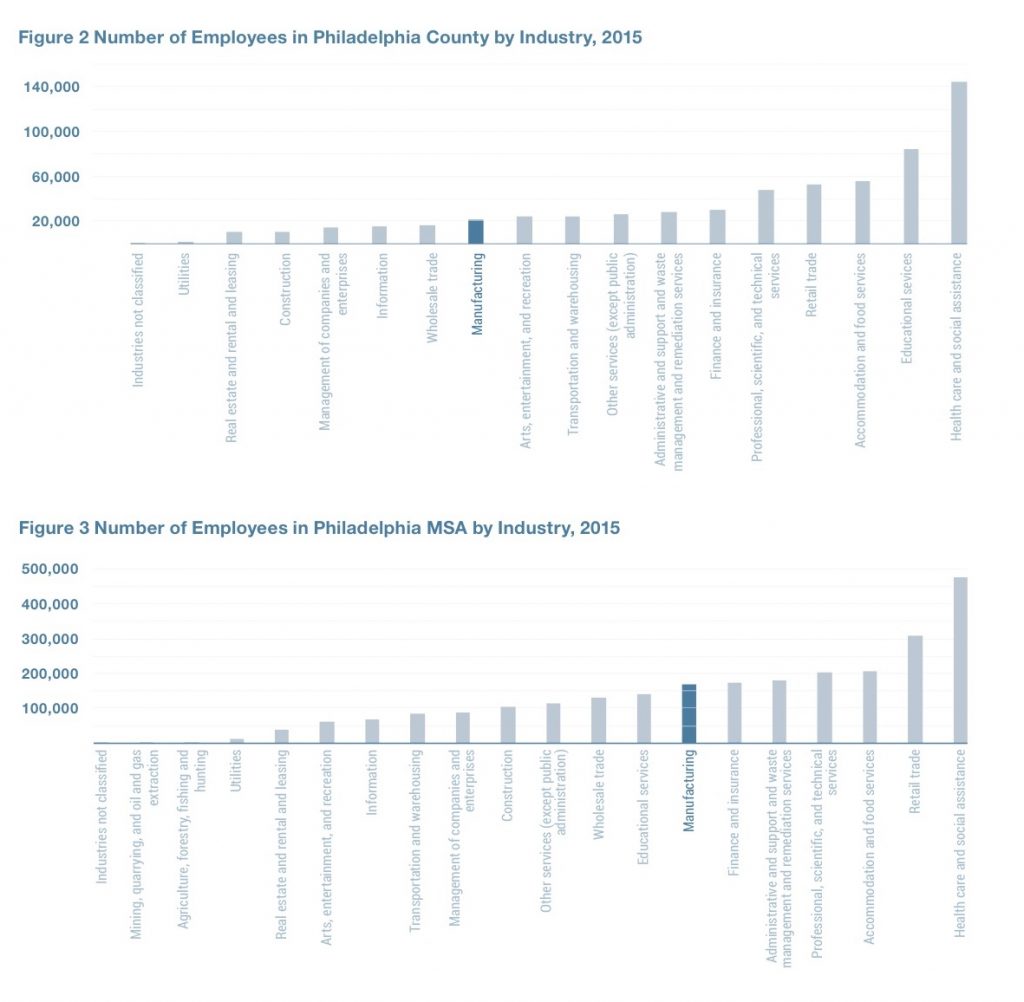

In 2015, the Philadelphia MSA had just over 2.5 million private sector employees, about 600,000 of whom worked in the city of Philadelphia. Figures 2 and 3 illustrate the distribution of employment by industry sector in the city and MSA as a whole. Health care and accommodation and food services played key roles at both the city and metro levels, but the combination of health care and educational services in the top two positions in the city lends credence to Philadelphia’s “eds and meds” reputation — a context for several discussions that came up during focus group conversations in the study.

Manufacturing Employment

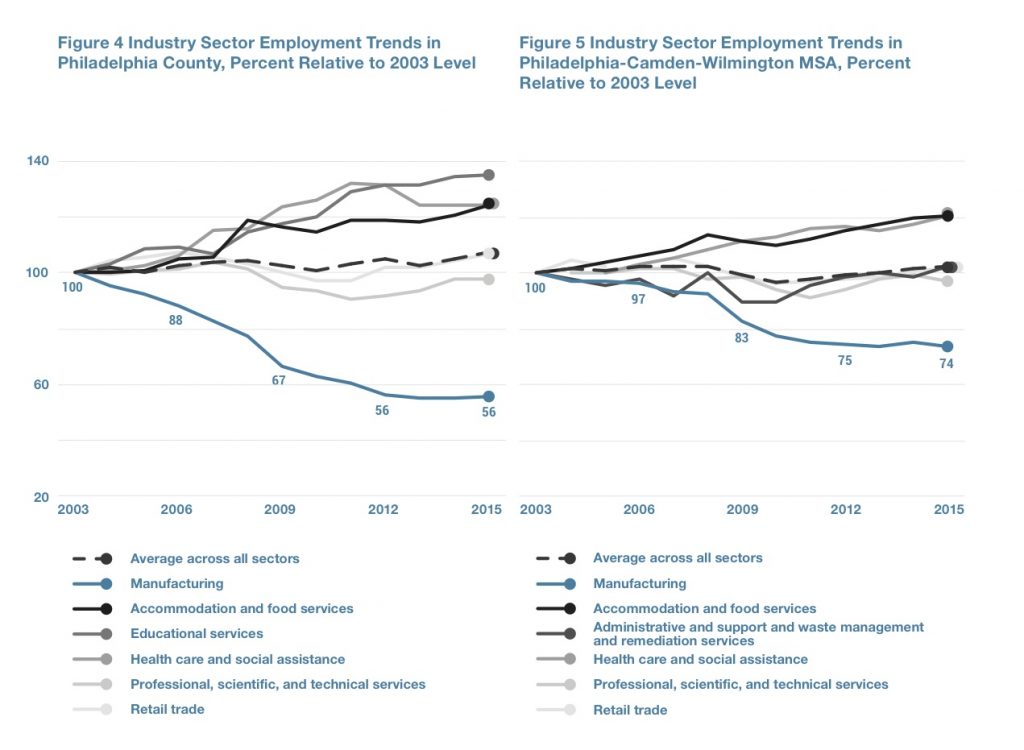

As Figures 2 and 3 illustrate, manufacturing was the seventh-largest sector in the MSA and the 11th- largest sector in the city in 2015. Figures 4 and 5 show the change in employment across the five largest industry sectors (by employment) in 2015 as well as manufacturing and total employment in the county and MSA between 2003 and 2015. Mirroring national trends, manufacturing employment in the MSA declined by one-quarter between 2003 and 2015, whereas employment in sectors such as arts, health care, accommodation and food services, retail, and education increased. However, much of the metropolitan area’s decline in manufacturing appears to be driven by losses in the city, which shed nearly 45 percent of the sector’s jobs in the same period.

Manufacturing Wages

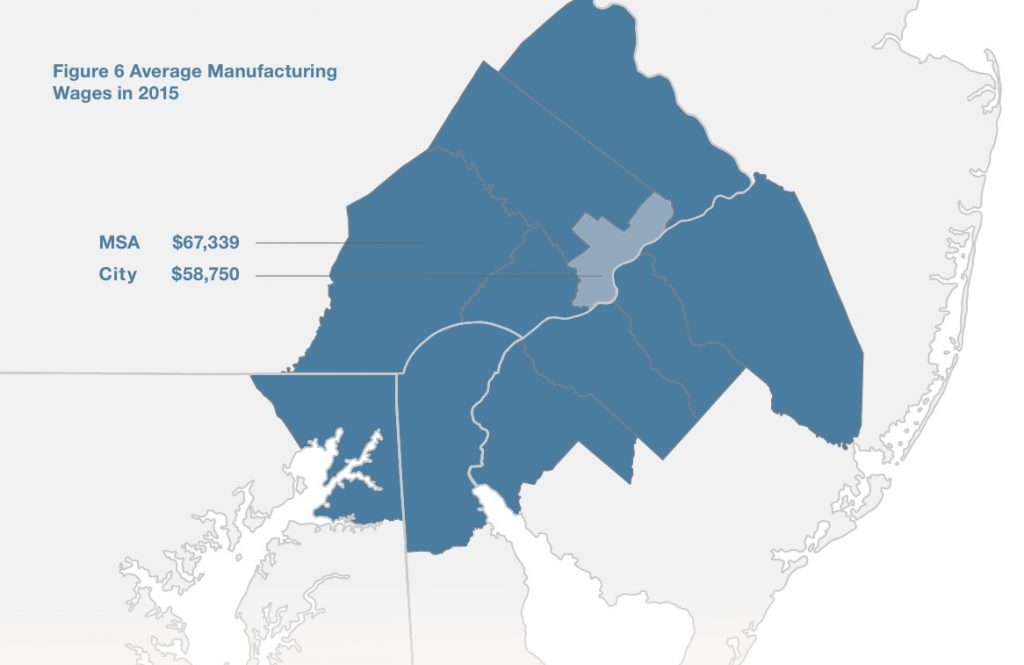

As shown in Figure 6, average wages in the sector were higher in the MSA than in the city in 2015 ($67,339 versus $58,750) and were substantially higher than the respective average wages for all sectors (19.3 percent higher in the MSA versus 5.3 percent higher in the city). In both the city and the MSA, with some exceptions, manufacturing wages were on a par with or higher than sectors that have similar educational requirements (e.g., retail, construction, transportation and warehousing, and wholesale trade), meaning that the sector is still a source of decent-paying jobs for workers with lower levels of formal education. Among survey respondents, the share of current production employees earning a base wage of at least $15/hour was 54.2 percent.6

As shown in Figure 6, average wages in the sector were higher in the MSA than in the city in 2015 ($67,339 versus $58,750) and were substantially higher than the respective average wages for all sectors (19.3 percent higher in the MSA versus 5.3 percent higher in the city). In both the city and the MSA, with some exceptions, manufacturing wages were on a par with or higher than sectors that have similar educational requirements (e.g., retail, construction, transportation and warehousing, and wholesale trade), meaning that the sector is still a source of decent-paying jobs for workers with lower levels of formal education. Among survey respondents, the share of current production employees earning a base wage of at least $15/hour was 54.2 percent.6

Key Manufacturing Subsectors

Since 2013, some subsectors of manufacturing have experienced slight employment growth in the MSA, including food, chemical, primary metal, paper, and wood product manufacturing; fabricated metal and apparel manufacturing losses have stabilized. In the city of Philadelphia, several subsectors began to stabilize or bounce back from 2013 to 2015, including nonmetallic mineral products, wood products, chemicals, and miscellaneous manufacturing. Paper, furniture, electrical equipment, and beverage and tobacco product manufacturing experienced slight growth in the city between 2014 and 2015.

Survey and Focus Group Findings: Overview

A total of 91 firms participated in the survey of Philadelphia manufacturers, with 80 (88 percent) completing it in full. Three focus groups discussed the state of urban manufacturing in Philadelphia: one attended by 12 small-scale manufacturers, a second attended by 10 medium-to-large-scale manufacturers, and a third including representatives from nine business support organizations. Insights from the focus groups supplied additional context to the understanding of the state of urban manufacturing as learned through the survey analysis.

Sector

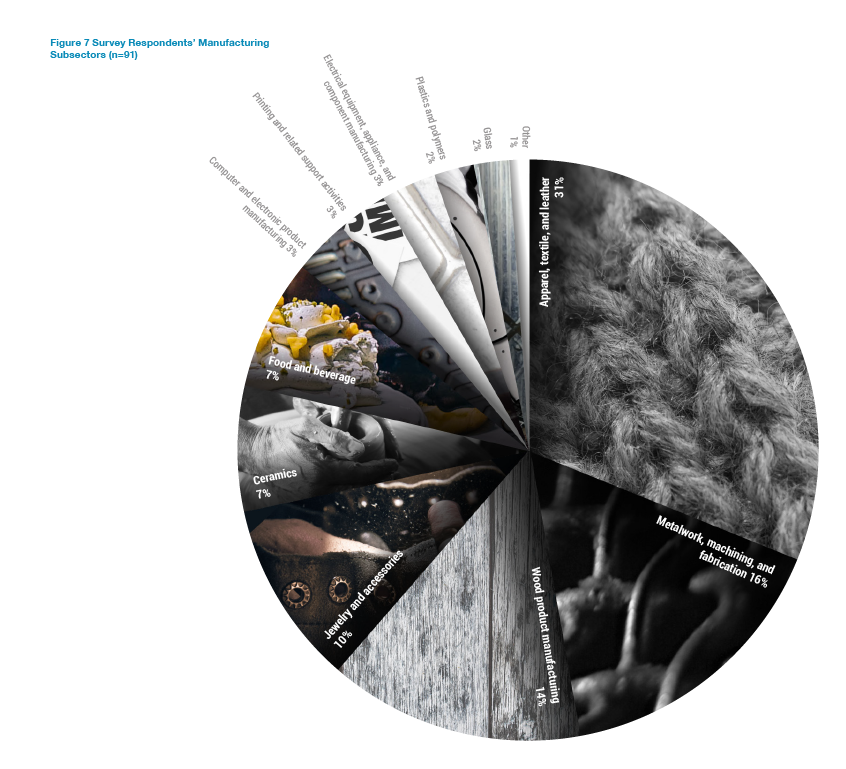

Figure 7 shows the distribution of manufacturing sectors represented by the survey respondents. Across sectors, respondents are making a wide variety of products, from rubber gaskets, elastomers, and home products from recycled vinyl records to commercial shipping vessels and helicopters.

Business Size and Age

The 88 firms that provided the necessary information were categorized based on size (as measured by number of employees) and age:

33% – Small, new (n=29)

47% – Small, established (n=41)

20% – Medium-to-large, established (n=18)

Growth Intentions

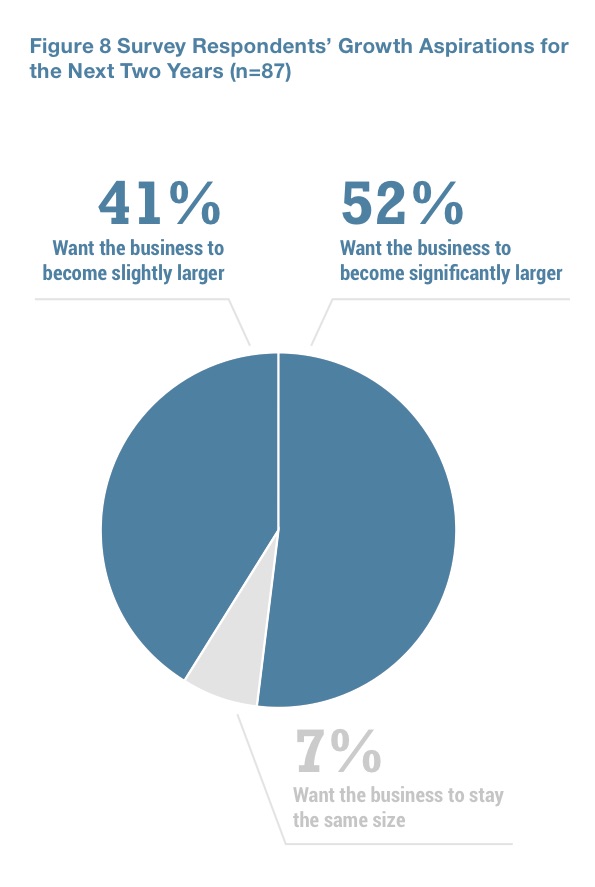

As Figure 8 demonstrates, almost all the respondents seem to have an appetite for growth in the next two years.

As Figure 8 demonstrates, almost all the respondents seem to have an appetite for growth in the next two years.

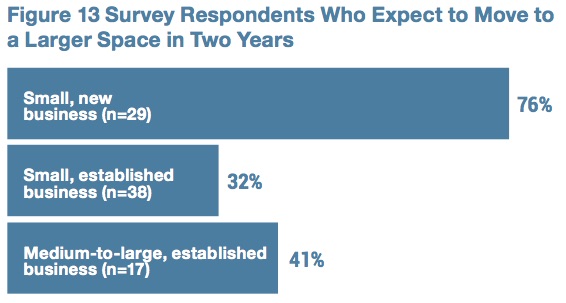

Small, new businesses are more bullish regarding future growth relative to the other two groups. More than three-quarters of small, new businesses expect to move to a larger space in the next two years, but close to one-third of small, established businesses expect the same. Similarly, small, new businesses demonstrated generally stronger expectations of future employment growth; almost 70 percent of single-employee firms plan to add staff in the future. Tempering these optimistic expectations are challenges this group faces in accessing capital. (See the Barriers to Scale section.) These findings suggest that small, new firms would be important targets for greater engagement by business support organizations.

Business Owner Definition

A substantial minority of these companies emphasized the high design content of their work. Asked to provide a one-sentence description of their business, one-third of respondents said some version of “We/I design and….” This is emblematic of the challenge many business owners and economic development practitioners have previously shared with UMA in effectively categorizing these firms for various services, programs, incentives, and policymaking. What differentiates a maker from a manufacturer? How do you classify a designer who happens to do some production or a producer who weaves design into each of her or his products? The survey included a question that allowed respondents to self-identify in an effort to help answer these questions.

Figure 9 shows the array of professional identities that survey respondents assigned to themselves and the shifts in their self-identification between their founding and today. Appreciably more respondents view themselves today as business people, manufacturers, and entrepreneurs than at founding. On the other hand, fewer think of themselves as makers or artists today than they did at the founding of their businesses. This suggests that as individuals’ business ideas become more established, their views of themselves shift from their craft to their role in the marketplace.

Market Orientation

Despite their small size, 62 percent of respondents (excluding the two largest employers) produce for national or international markets. More than half of respondents reported that consumers are the main market for their product, far outnumbering designers/engineers, manufacturers, retailers, wholesalers/distributors, and governments.

The Manufacturing Support Ecosystem in Philadelphia

An important reason that both UMA and the Philadelphia Fed felt compelled to include Philadelphia in the State of Urban Manufacturing was a desire to better understand the business support services available in the city and to learn from businesses if and how such services might be delivered more effectively. Both organizations were also interested in whether growth opportunities in the manufacturing sector reach communities that would benefit from the employment and wealth generation that are associated with them.

Service Providers

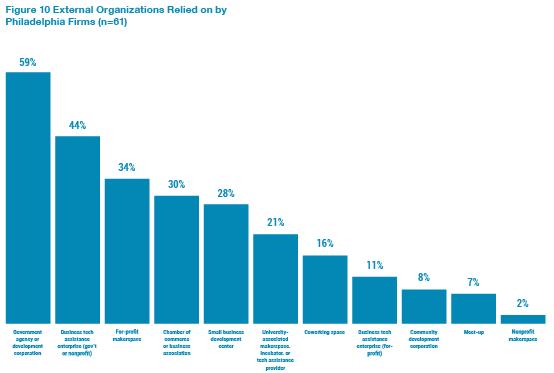

The two-thirds of survey respondents who completed a question related to support organizations listed a total of 25 entities that they had used. As Figure 10 illustrates, certain types of organizations are more widely used than others, with government agencies/development corporations, business technical assistance enterprises, and makerspaces being the most commonly mentioned organization types.

The two-thirds of survey respondents who completed a question related to support organizations listed a total of 25 entities that they had used. As Figure 10 illustrates, certain types of organizations are more widely used than others, with government agencies/development corporations, business technical assistance enterprises, and makerspaces being the most commonly mentioned organization types.

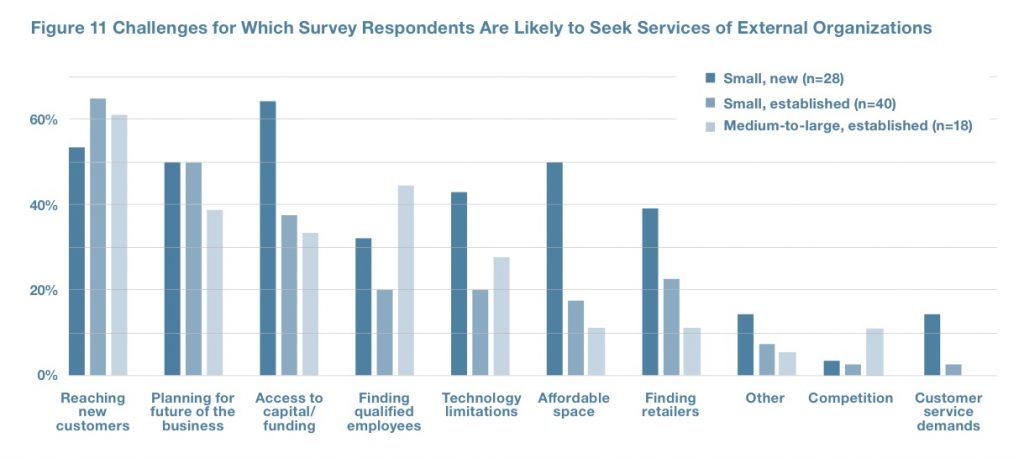

Figure 11 shows that across all survey respondents, the most commonly cited challenges for which they would seek the help of an outside organization were “reaching new customers” and “planning for the future of the business.” Small, new firms are disproportionately more likely to seek services to access financing or obtain affordable space, whereas a larger share of medium-to-large, established firms would seek help finding qualified employees than the other groups.

Focus group participants shared that ineffective communication about available programs and services, coupled with the complex bureaucratic environment, contribute to a lack of awareness of the support services and resources that exist for makers and manufacturers in Philadelphia. The focus groups and survey responses both indicate that resource and program providers may not be reaching the small manufacturers that most require or could most benefit from their support. Additionally, some participants felt that economic development incentives were hard for small businesses to access and typically go to the businesses able to hire specialized help in obtaining those incentives. Some felt that the city of Philadelphia’s economic development strategies are predominantly focused on the “eds and meds” sectors, with not much attention currently dedicated to bolstering the manufacturing industry.

Collaboration

Despite challenges, focus group participants spoke about the encouraging — and increasing — amount of collaboration among makers and manufacturers in the Greater Philadelphia region. Almost half of the firms surveyed reported using makerspaces.7 An active and robust network of makerspaces and maker meetups in Philadelphia appears to play a more important role in meeting the needs of Philadelphia’s maker-identified manufacturing firms than do makerspaces in some other cities.8 The larger role that makerspaces and incubators appear to play in Philadelphia may owe to a less organized small-production ecosystem in the city. These spaces may play a larger role in fostering and nurturing a sense of community among new and would-be business owners. Focus group participants shared that collaboration was also seen in the collective advocacy for industry-focused training programs and by sharing referrals to vendors with one another. Some focus group participants also noted, however, that smaller business owners are often “too busy working in the business to take time to work on the business,” as the saying goes, which can prevent them from finding time to collaborate to a greater degree to either advance their strategic business goals or the sector more generally.

Barriers to Scale

Access to Capital

A substantial proportion of both survey respondents and focus group participants indicated that the top barrier to scale was the difficulty in accessing sufficient working and growth capital, which limited their ability to run and expand their businesses, as shown in Figure 12. Of particular note, half of firms surveyed indicated that they had foregone sales opportunities in the past year owing to limited production capacity that was constrained, at least in part, by being able to access capital to expand their operations. Focus group participants also lamented the lack of a sizeable, active venture capital community in Philadelphia to help furnish startup capital. More than half of small, new firms ranked access to capital as their top challenge, compared with less than a quarter of small, established firms or medium-to-large, established firms.

More than three-quarters of survey respondents used their own money to start their business, almost double the number in the next-highest category, who used loans, investments, or gifts from family and friends. Bank loans and venture capital were relatively uncommon sources of startup capital used by survey respondents.9 The reliance on personal capital or funds from family and friends speaks to a potential barrier to those who lack both the financial and social capital needed to support entrepreneurial pursuits.

Supply Chain and Production Capacity

Focus group participants mentioned challenges in their supply chain. For example, several comments were made about the lack of contract manufacturers in Philadelphia. Additionally, participants shared that the few available contract manufacturers either do not bring the same attention to detail or focus on design, or their required minimums are too high to accommodate small production runs. While this issue emerged during focus groups, only 13 of 83 survey respondents (16%) who answered the question indicated that they used contract manufacturers.

Reaching New Customers

Figure 12 shows that nearly one-quarter of respondents ranked “reaching new customers” as their top challenge; more than 60 percent ranked it among their top three challenges. This challenge was rated as the most significant faced by small, established firms.

Labor Force

At least 70 percent of respondents plan to add employees in the future, but finding qualified workers is a concern; 13 percent of survey respondents ranked it as their top challenge, and more than a third listed it among their top three business challenges. Finding qualified employees is an issue that disproportionately affects medium-to-large, established businesses.

With many current employees retiring, some manufacturers described a skills gap keeping them from finding qualified labor to fill vacant positions. Although the maker movement is gaining popularity among some millennials, manufacturing is not seen as an attractive career path, nor is it encouraged or promoted in high schools. Focus group participants expressed that many people still attach an outdated stigma to manufacturing as a career option and do not account for the changes in the sector that benefit from greater use of technology as well as the ability to integrate more creative elements into significant tranches of production work. The Community College of Philadelphia is working to expand its technical training programs, and several participants said that increased career and technical education or vocational education in high school would help to address this challenge. In 2015, the Benjamin Franklin High School Center for Advanced Manufacturing opened as a magnet high school. The school works with industry and state o cials to prepare students for manufacturing career paths.10

Other Strengths and Weaknesses

In the focus groups, several additional themes emerged on the strengths and weaknesses of Philadelphia as a home for manufacturers.

Municipal Issues

Focus group participants reported that bureaucratic burdens related to licensing, inspection, zoning, and land use are unfriendly to business. Supporting concerns expressed in the focus groups related to high taxes — Philadelphia’s Manufacturing Task Force recently compared the city with nine other locations with similar manufacturing clusters and subsectors, and it found Philadelphia to have the highest tax burden among the group of 10 localities.11 Focus group participants also echoed other findings in the report that local, state, and federal regulations are not coordinated and often conflict, which increases real and perceived burdens for business owners.

Real Estate

Focus group participants noted that there is available industrial space in Philadelphia. However, to accommodate their particular production needs, some participants sought first-floor space, which is now — and has historically been — in short supply in the city. As Figure 11 illustrates, smaller, newer firms seek services to address affordable space more than the other groups; half of small, new firms listed “affordable space for my business” as a challenge for which they would seek services of an external organization, whereas only about one in five small, established businesses, and one in nine medium- to-large, established businesses reported the same. Figure 13 shows that 76 percent of small, new businesses expect to move to a larger space in the next two years, compared with lower shares of small, established businesses and medium- to-large, established businesses.

Focus group participants noted that there is available industrial space in Philadelphia. However, to accommodate their particular production needs, some participants sought first-floor space, which is now — and has historically been — in short supply in the city. As Figure 11 illustrates, smaller, newer firms seek services to address affordable space more than the other groups; half of small, new firms listed “affordable space for my business” as a challenge for which they would seek services of an external organization, whereas only about one in five small, established businesses, and one in nine medium- to-large, established businesses reported the same. Figure 13 shows that 76 percent of small, new businesses expect to move to a larger space in the next two years, compared with lower shares of small, established businesses and medium- to-large, established businesses.

Cost of Living and Geographical Location

During focus groups, Philadelphia’s relatively low cost of living was frequently cited as an advantage over nearby cities such as Washington, D.C., or New York. The city’s close proximity to these and other large East Coast markets was also seen as advantageous. Additionally, even though some new firms struggle with affordability, participants said that real estate is significantly cheaper in the city than it is in surrounding counties.

Workforce Practices

Skills and Training

Skills and Training

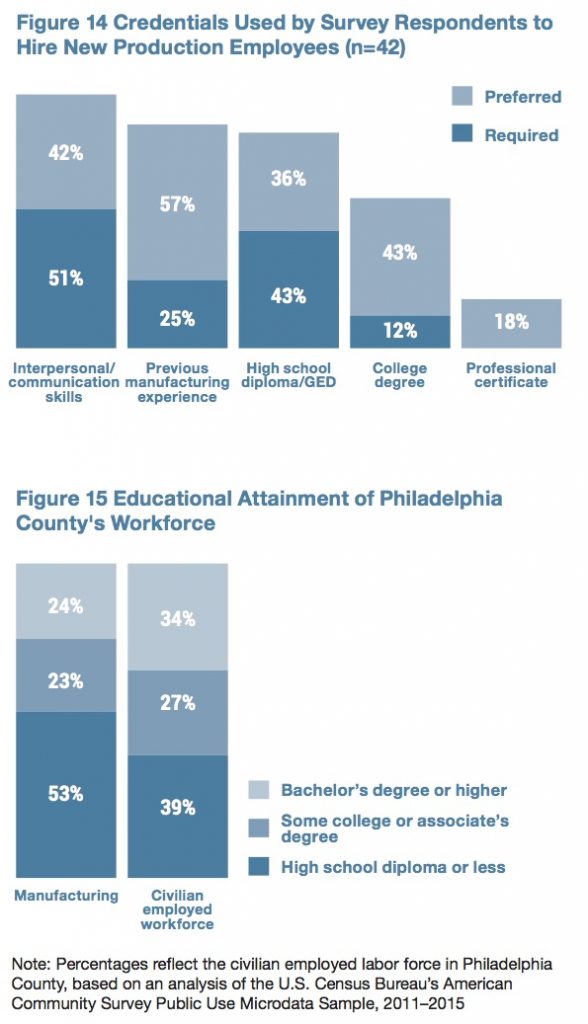

As shown in Figure 14, interpersonal and communication skills are critical criteria that business owners use to evaluate job applicants for production roles. One reason for this may be that very small manufacturers need to hire staff who are capable of filling both production and nonproduction roles such as customer service, logistics, and troubleshooting.

Previous manufacturing experience and a high school diploma or GED are other important requirements; fewer businesses require new production employees to have a college degree. Roughly 86 percent of production workers employed by survey respondents have less than a bachelor’s degree.12 As seen in Figure 15, only 24 percent of manufacturing workers in Philadelphia County have a bachelor’s degree or higher, compared with 34 percent for the overall civilian employed workforce.

Work-based training is an important tool that industry employers currently use to ensure their workforce has relevant skills, with almost three out of every five respondents offering an in-house apprenticeship or internship program(s) to production employees.

Recruitment

Recruitment

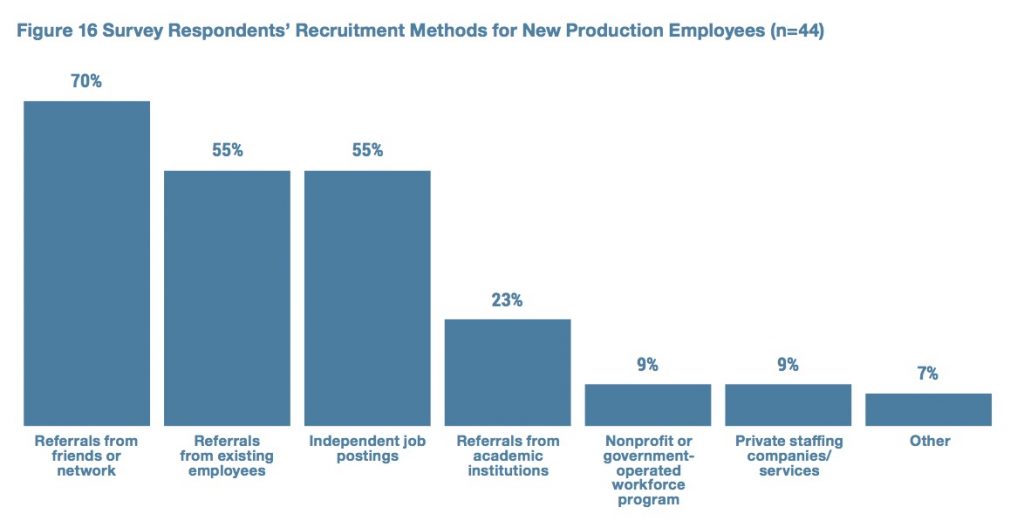

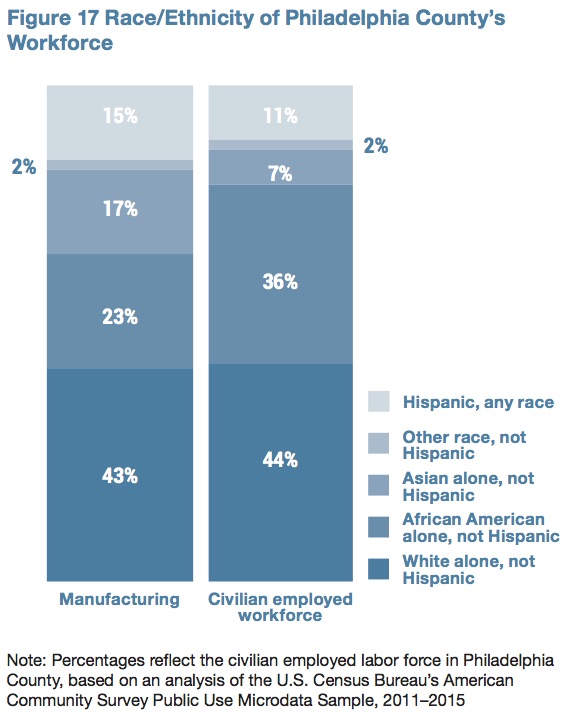

Figure 16 shows that referrals are the most common way that new employees are found in the manufacturing sector, which indicates that social capital plays a key role in hiring. Independent job postings are a second important method, used by just over half of the respondents. Although the prevalence of referrals as a recruiting tool could lead to the hiring of employees who come from similar backgrounds as the business owners, Figure 17 shows that the racial composition of the manufacturing workforce in Philadelphia County is somewhat consistent with the county’s overall workforce as far as white and Hispanic populations are concerned. African-American workers are underrepresented in manufacturing, whereas Asian workers are overrepresented.

Figure 16 shows that referrals are the most common way that new employees are found in the manufacturing sector, which indicates that social capital plays a key role in hiring. Independent job postings are a second important method, used by just over half of the respondents. Although the prevalence of referrals as a recruiting tool could lead to the hiring of employees who come from similar backgrounds as the business owners, Figure 17 shows that the racial composition of the manufacturing workforce in Philadelphia County is somewhat consistent with the county’s overall workforce as far as white and Hispanic populations are concerned. African-American workers are underrepresented in manufacturing, whereas Asian workers are overrepresented.

Workforce Diversity

Workforce Diversity

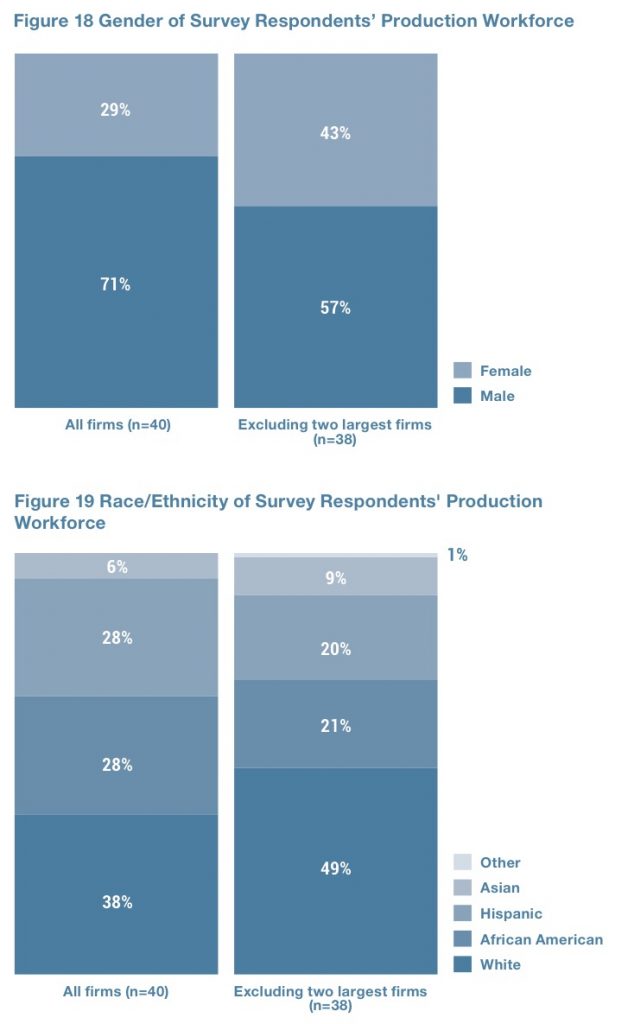

There appear to be differences in racial diversity, gender diversity, and education levels of workers between larger and smaller survey respondents. As Figure 18 illustrates, over 70 percent of production workers employed by all survey respondents are male; however, the share falls to 57 percent when the two largest employers are excluded. Although smaller respondents appear to achieve a greater level of gender balance, Figure 19 shows that they are also less racially diverse. Production workers employed by all respondents are relatively evenly split among white, African American, and Hispanic or Latino groups. However, when the two largest employers are excluded from survey results, the share of white workers rises to 49 percent. Three- quarters of survey respondents indicated that they do not take specific actions to hire from underrepresented populations.

Opportunities

With 93 percent of surveyed businesses looking to grow and 50 percent of all respondents indicating that they passed up business because production capacity could not meet demand, finding opportunities to nurture the manufacturing sector in Philadelphia could help advance the sector and the city’s economy. Based on a greater understanding of Philadelphia’s manufacturing landscape made possible by this study, there are several opportunities to bolster urban manufacturing in Philadelphia and support the industry’s growth. These include:

Nurture the Ecosystem of Small Manufacturers

Nurture the ecosystem of small manufacturers by, among other things, creating a local brand. Focus group participants discussed the creation of a local brand such as “PHL MADE,” consistent with branding efforts pursued in other cities, such as SFMade, Made in NYC, and Portland Made.13 Some participants felt that differentiating themselves as local manufacturers and makers would provide a competitive advantage with customers seeking locally made products as well as with angel investors and other potential capital sources. The primary obstacle, according to participants, is finding a party willing to take on the accountability, ownership, and costs of creating, shepherding, and maintaining the brand on an ongoing basis.

Improve Communication Regarding Available Programs and Services

The appetite for growth expressed by survey respondents suggests there is a significant opportunity to link business support services to more manufacturers. Industry service providers who participated in the research shared success stories about how available programs and services supported the creation or expansion of local production businesses. Participants that represented businesses located in the city, however, had varying levels of awareness regarding these services. This points to the need for improved communication between service providers and local production firms. Many businesses lamented that there was not a one-stop source of information to help them navigate a complex web of programs, systems, and incentives, most of which have detailed nuances in terms of applicability and eligibility.

Increase Access to Capital

Access to capital is a much greater challenge for smaller, newer businesses than for their larger or more established counterparts. More than 50 percent of small, new firms ranked this as their top challenge, compared with 23 percent of small, established firms and 17 percent of medium-to-large, established firms. In addition to increasing access to capital for the industry overall, service providers can work with small, new firms to connect businesses with sources of startup capital and bolster the presence of local venture capital in the city.

Support the Expansion and Rebranding of Career and Technical Education

Manufacturers in Philadelphia are challenged to find workers trained in the skills needed to fill jobs in the rapidly advancing manufacturing industry. An expansion of career and technical education at the high school and community college levels could help prepare the workforce for current and future job opportunities in the manufacturing sector. A campaign to alter the perception of manufacturing — among students, parents, guidance counselors, and adult jobseekers — could create greater awareness of manufacturing career options, particularly for those without a college degree.

Conduct Further Research

- Although this report highlights the current state of urban manufacturing in Philadelphia, it leaves room for further analysis of existing data and future research. Potential areas for future exploration include:

- The specific challenges or combinations of circumstances that appear to prevent the smallest firms from expanding.

- How business owners define themselves, how and why definitions change over time, and whether their sense of identity corresponds to their business growth trajectories. UMA is particularly interested in understanding whether owners who think of themselves as something other than a business person or manufacturer are less inclined to access the types of business support services, incentives, and similar programs that are typically described as supporting manufacturing businesses — and, if so, if a rebranding or reorienting may be in order.

- The use of contract manufacturers, and whether an expansion of their use would prove beneficial to some subset of small manufacturers in Philadelphia.

- What impact, if any, smaller firm size has on the recruiting, hiring, and training processes for those firms.

- The issues of racial and gender diversity in the manufacturing sector, and what steps could be taken to promote equitable access to available jobs in the sector for underrepresented groups.14

Authored by Mark Foggin, Urban Manufacturing Alliance; Noelle St. Clair and Juliet Downie, Federal Reserve Bank of Philadelphia

Acknowledgements

Thank you to Lee Wellington and Katy Stanton from the Urban Manufacturing Alliance, Laura Wolf-Powers, Ph.D., from the City University of New York Hunter College, and Keith Wardrip and Theresa Y. Singleton of the Federal Reserve Bank of Philadelphia for their guidance on this research. We received helpful support with data collection from Andrew Dahlgren, adjunct professor at the University of the Arts, Philadelphia, and Karen Randal, founder and director (retired), Office of Business Attraction and Retention, City of Philadelphia’s Department of Commerce. Thank you to Tanu Kumar at Pratt Center for Community Development and Case Wyse at Pratt Institute’s Spatial Analysis and Visualization Initiative for their additional analysis of manufacturing data at the metropolitan level. Thank you to Adam Friedman at Pratt Center for Community Development and Greg Schrock, Ph.D., at Portland State University for their invaluable thought leadership throughout this process. Additional support for the State of Urban Manufacturing was provided by Emily Holloway from Hunter College, and Johnny Magdaleno and Eva Pinkley from UMA.

Finally, thank you to the survey respondents and focus group participants for their time and insights, without which this report would not have been possible. The views expressed in this report do not necessarily reflect the views of the Federal Reserve Bank of Philadelphia or the Federal Reserve System.

Endnotes

1. These included Atlanta; Baltimore; Buffalo, NY; Charlotte, NC; Chicago; Cincinnati; Detroit; Houston; Los Angeles; Milwaukee; New York; Philadelphia; Portland, OR; Salt Lake City; San Francisco; and San Jose, CA.

2. County-level data can be used to analyze manufacturing trends in the city because Philadelphia County is exactly coterminous with the city of Philadelphia. Both geographic terms are used interchangeably in this report to describe city-specific data.

3. The MSA includes Philadelphia, Delaware, Bucks, Montgomery, and Chester counties in Pennsylvania; Salem, Gloucester, Camden, and Burlington counties in New Jersey; New Castle County in Delaware; and Cecil County in Maryland.

4. Laura Wolf-Powers, Marc Doussard, Greg Schrock, Charles Heying, Max Eisenberger, Steve Marotta, The Maker Economy in Action: Entrepreneurship and Supportive Ecosystems in Chicago, New York and Portland. Portland, OR: Portland State University, 2016. Available at http://www.urbanmakereconomy.org/.

5. The estimates provided in this section are based on an analysis of the U.S. Census Bureau’s County Business Patterns data from 2003 to 2015, obtained for Philadelphia County (coterminous with the city of Philadelphia) and the Philadelphia-Camden-Wilmington MSA.

6. According to the weighted average produced by weighting the shares of such employees by the total number of employees at each business.

7. Of the 50 respondents who answered the questions regarding makerspaces, 23 (46 percent) had used a makerspace, and 27 (54 percent) had not. NextFab and the Philadelphia Fashion Incubator were frequently mentioned.

8. In their study of maker enterprises in Chicago, New York City, and Portland, Wolf-Powers, et al., found that 74 percent of respondents reported never having utilized the services of a makerspace. See Laura Wolf-Powers, et al., “The Maker Movement and Urban Economic Development,” Journal of American Planning Association, 1–12 (2017), pp. 365–376.

9. Note that this question allowed respondents to select all options that apply.

10. See more at https://nextcity.org/daily/entry/philly-schools-new-tech-career-training-center.

11. PIDC, “A Manufacturing Growth Strategy for Philadelphia,” December 2013, available at http://www.pidcphila.com/images/uploads/resource_library/FULLREPORTManufacturingGrowthStrategyFINAL.pdf.

12. Forty-one survey respondents were included in the calculation for this weighted average (among only those businesses with employees besides the owner).

13. See https://sfmade.org/, https://madeinnyc.org/, and https://www.portlandmade.com/.

14. One set of recommendations can be found in UMA’s, Pratt Center’s, and PolicyLink’s Prototyping Equity report, available at http://www.prattcenter.net/eie/strategies.